Apr

27

The Ultimate Guide to Financing Roll Off Trucks for Your Business

Discover how to finance roll off trucks for your business in ‘The Ultimate Guide to Financing Roll Off Trucks for Your Business’.

Apr

12

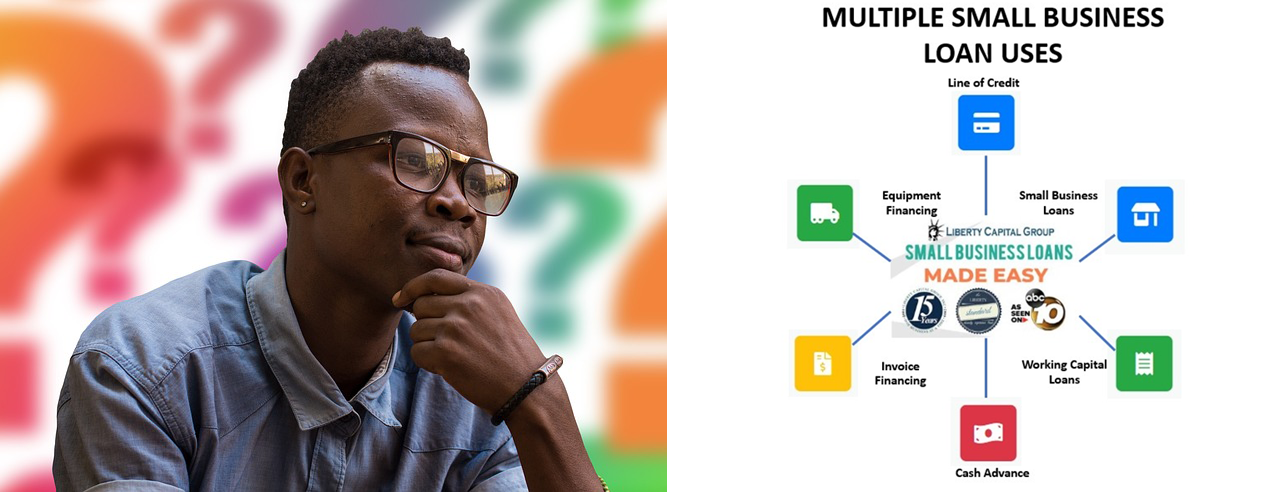

Unlock the Potential of Your Business with Flexible Financing Options

Discover how to unlock the potential of your business with flexible business loans in our blog ‘Unlock the Potential of Your Business with Flexible Financing Options’.

Apr

8

Navigating Fast Funding Solutions: Tips for Quick and Effective Financing

Discover quick and effective tips for fast funding solutions in our blog ‘Navigating Fast Funding Solutions: Tips for Quick and Effective Financing’.

Apr

6

The Ultimate Guide to Business Growth Financing for Small Businesses

Explore essential strategies for securing business growth financing in our comprehensive guide ‘The Ultimate Guide to Business Growth Financing for Small Businesses’.

Mar

27

20th Anniversary Commercial Truck Financing Solutions

As Liberty Capital Group, Inc. commemorates its 20th anniversary, it symbolizes two decades dedicated to empowering businesses with innovative financing solutions. Evolving from its origins as a commercial truck financing broker, Liberty Capital Group now offers a diverse range of loan types, including crucial fast cash working capital a necessity

Jul

14

Business Loan Application

Mar

24

Low-rate hangover!!

What is prime rate? The prime rate is the interest rate that banks charge their most creditworthy customers for loans. It is typically set at a level that is above the federal funds rate, which is the interest rate at which banks lend money to each other overnight. The prime

Mar

3

Small Business Lending: Personal Guarantees and UCC Filings

Feb

28

PPP loans – When the Time Comes to Pay the Piper