Automotive Repair Equipment Financing

Get Competitive Rates for Your Automotive Repair Equipment Financing

- Automotive Lift Equipment Finance

- Tire Changer Equipment Financing

- Alignment Machine Financing

- Diagnostic Test Software and Equipment

- Lift and Bays, Rotators

- Monthly payments

- Terms up to 5 years

- NO down payment

- Startup OK!

Get Competitive Automotive Repair Shop Equipment Financing.

Are you looking to Finance Automotive repair equipment?

We know automotive repair industry when it comes to financing. For 20 years, we’ve helped Auto Repair, Body Shop and Tire Shops with financing their bay lift, alignment machines, tire changer, and many more. Good Credit? We can get Automotive Repair Shop owners like you fast approval with application only up to $250k without financials.

Bad Credit? No problem. Let’s talk about your options with a little leg work we’ll get you there. We’ll graduate you to APP-ONLY someday.

With financing and leasing compared to traditional lenders:

Here’s what you would expect to get when you finance equipment with us.

- Up to 120% of the total cost

- $0 Down Equipment Financing

- Up to $250,000 with a simple one-page application

- Up to $5,000,000 with financial disclosure

- Next-day funding with pre-funding available for approved equipment vendors

- 90-day deferred payment options

- Low Doc funding

- Pre-Funding vendors no problem

- Eligibility for all new and used equipment purchases.

- No age restriction on certain equipment

- Startups ok!

A Wide Range of Automotive Repair Shop Equipment Financing Solutions…

Whether replacing outdated or expanding your automotive brand you’re authorized to repair, you will need an updated mnufacturing quipment to support wide range of auto makers. Expanding allows you to expand without having huge capital outlay for equipment. Create a monthly budget of what you can afford, work backward. Get Pre-Approved based on that and what equipment you can get for the time being. As time, you will have more access to bigger capital. Liberty Capital can create a flexible and affordable payment solution for all your Automotive Equipment Financing. We can minimize cost and maximizes return. Liberty Capital makes leasing. We can get you pre-approved then find the equipment based on the budget. We can always break it up into Multiple Funding Lines.

In addition to Standard Leases* we offer Flexible Payment Plans.

- $99 for the first 12 months: Requires only $99 to start.

- 90-Day Deferral: NO payment for the first three months

- Low Credit accepted for well established companies.

- 0% Interest Promotion for well qualified auto shops

- No balloon equipment financing

- Fast approvals Online Application only up to $250,000.00, full financials above $250,000.00

- Equipment finance agreement, or equipment leases terms from 12 – 60 months.

Auto Repair Shop Financing through Liberty Capital can have wide ranging Credit Profile under one roof. We cater to all including all types of funding for the automotive repair busines including unsecured loans for working capital to grow with marketing and adding new staff.

These solutions typically involve two primary options:

- Repair Shop Equipment Financing: Businesses secures equipment financing for repair shop and manufacturing equipment in the facilities. These equipment financing allow businesses to spread the cost of the equipment over time, making it more affordable for Business Owners with equipment financing while benefiting for the advantages of financing.

- Repair Shop Equipment Leasing: Leasing involves off-balance sheet financing in the form of Fair Market Value (FMV). During the lease term, the business pays regular payments to the leasing company. Payments is deducted 100%. At the end of the lease term, the business may have the option to purchase the equipment, typically, 10% or based on current fair market value. Or, return the equipment, or negotiate a new lease agreement for upgraded equipment. Good for depleting equipment. Those that becomes obselete quickly. Get new one every 3 years.

Both Automotive Repair Shop Financing and Leasing options offer benefits such as Preserving Cash Flow, avoiding large upfront costs, and providing flexibility in of consistently having an updated equipment. Additionally, financing and leasing solutions for equipment may include maintenance, installation, delivery and service agreements.

Automotive Equipment Financing for Startups

Having the most reliable and upgraded automotive equipment for your start up business can make you compete with the old folks across the street. Acquiring an updated equipment will allow you to service cars no others can. With affordable and Fixed Monthly Payments, you are brining a lot to your start up business with little to no capital outlay. You can have a lot of benefits for your start up business if you Lease your automotive equipment. It depreciates in value so you can always upgrade when lease ends. It can save you working capital to use towards hiring the best people, moving to a new location, inventory and supplies. Compared to banks, Liberty Capital leasing program is best for any auto repair shops needing new funding.

Advantages to you when you finance equipment include:

- Up to 120% of equipment cost

- Up to $250,000 with a simple one-page application

- Up to $2,000,000 with financial disclosure

- Pre-funding for qualified equipment vendors available

- 12 – 60-month fixed payment terms

- No down payment for Qualified Borrowers

- Lowest Rates in the industry for qualified borrowers

- Eligibility for all new and used equipment purchases.

- Does not report to personal credit.

Credit Requirements for startup auto repair shops:

- Business license or active business entity with the secretary of state

- Personal Guarantees required from all owners

- Minimum 650 credit score

- No bankruptcies in the last 7 years

- No unresolved tax liens

- Business bank account/FED ID

Liberty Capital canget you pre-approved for Automotive Shop Equipment with easy with our simple Online Application. Shop confidently! Our team is available to assist shop owners to accommodate your expansion needs. Working with any vendors of your choice, our financing options will pay the vendor including taxes, delivery and installation. We tailor to fit your budget. Vendor might always offer Vendor Financing, but Liberty Capital as a Super Business Loan Broker with 20 years of experience, you’ll be taken care of.

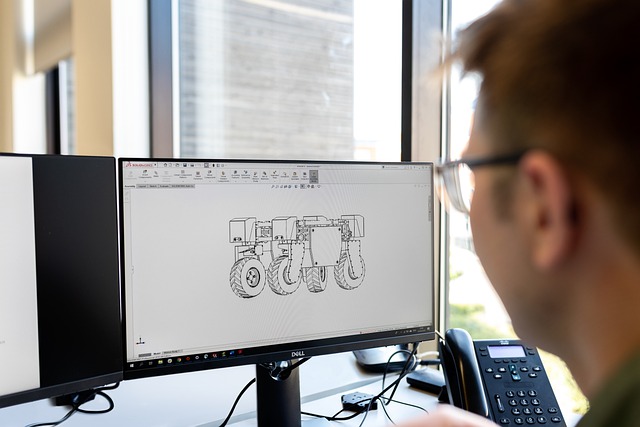

What Auto Repair Shop Equipment Can Be Financed?

- Automotive lift equipment

- Tire changer equipment

- Alignment Machine financing

- Diagnostic Test software

- Tuning Equipment

- Lift and Bays, Rotators

- Equipment purchases are tax deductible.

- Soft costs, installation and delivery included

- Painth Booths, Sprayers and many more

- Tow Trucks & Wrecker Trucks

- ForkLifs – Auto Rakcs

The Automotive Repair Equipment Vendor? What part do they play?

We have utilized our years in business, experience in verifying and vetting many Equipment Vendors, and formal resources to weed out vendors that are not well suited for our customers. To that end, we recommend looking for those who are rupatable. We can get the vendor approve for you as well. To avoid fraud, we work with you to make sure your successful protected from unscrupulous vendors . You’re likely to stop paying for a lemo, so be careful. Don’t easily send Security Deposit. Contact us quickly before putting any down payment to any vendors without verifying thier history. We can do that for you! Call us 888-588-4128.

What type of Funding for Auto Repair and Body Shop Owners need to expand:

- Build-Out Capital: This type of funding is essential for covering the costs associated with renovating or constructing the physical space for the repair shop, including leasehold improvements, construction materials, interior design, and signage.

- Equipment Financing: Business owners often require financing to purchase or lease equipment necessary for their operations, such as bays, lift and other that can be part of the build-out, refrigeration units, Racks, POS systems, and Furnitures. Equipment financing allows them to acquire these assets without depleting their capital reserves.

- Line of Credit: A line of credit provides business owners with flexible access to funds to cover short-term expenses or manage cash flow fluctuations. It can be used for various purposes, including purchasing inventory, covering payroll costs during slower periods, or addressing unexpected expenses.

- Payroll Funding: To ensure smooth operations and retain qualified staff, business owners may need funding to cover payroll expenses. This type of funding can help them meet their payroll obligations during periods of low revenue or when facing unexpected financial challenges.

- Inventory Financing: Business owners rely on a steady supply of ingredients and supplies to meet customer demand. Inventory financing allows them to purchase inventory in bulk or maintain adequate stock levels without tying up their working capital. This type of funding is particularly beneficial for seasonal businesses or those experiencing fluctuating demand.

By leveraging these types of funding, auto body, auto repair and automotive shop owners can effectively manage their expansion plans, invest in essential assets, maintain cash flow stability, and position their business for long-term success. With Liberty Capital’s 20 years of Experiences, we have the right loan for you.

So, if you want expand your shop, Liberty Capital will handle working capital, term loans, lines of credit and especially equipment, as long as it’s on the invoice, we’ll consider financing it. All can be financed sometimes even COMMERCIAL TRUCKS FINANCING if you have an auto body, repair shop with or without the towing, tow truck services with compound or not, you have the option to add to your business model if you haven’t to increase revenue. New opportunity await with Automotive Shop Financing.

Apply now to get your business capital to grow. Call now 888-511-6223.

The Automotive Repair and Body Shop Equipment Application Only up to $250,000

One of the utmost necessities for a repair shop equipment. It’s imperative to ensure that operational equipment, which serves as an asset for the company, is well-maintained and kept current. Equipment loans or leasing are viable routes for expanding restaurants. Leasing, in particular, offers numerous advantages, though they won’t be explored here today. One notable benefit of equipment leasing is the accompanying tax advantages, cashflow saving, inflation buster and safety from obsolecense. Call us today! Apply Now.

Covers many types of equipment

Easier to get than a traditional business loan

FAQ about Auto Repair and Body Shop Equipment Financing

Understanding Equipment Financing for Auto Repair and Body Shops

Auto repair and body shops rely on specialized equipment to provide quality services to their customers. However, acquiring this equipment can be costly, especially for new or expanding businesses. Equipment financing offers a solution by providing the necessary funds to purchase or lease equipment while spreading the cost over time. This FAQ addresses common questions about equipment financing for auto repair and body shops.

1. How does equipment financing work for auto repair and Body Shops?

Equipment financing allows auto repair and body shops to acquire the equipment they need without paying the full cost upfront. Instead, the business secures a loan or lease agreement with a lender, which covers the purchase or lease of the equipment. The business then makes regular payments to the lender over a set period, typically monthly, until the loan or lease is paid off.

2. What types of equipment can be financed?

Auto repair and body shops require various types of equipment, including diagnostic tools, lifts, tire changers, paint booths, and welding equipment. Equipment financing can be used to acquire both new and used equipment, allowing businesses to choose the options that best suit their needs and budget.

3. What are the benefits of equipment financing for auto repair and body shops?

Equipment financing offers several benefits for auto repair and body shops, including:

– Preservation of capital: Instead of tying up capital in equipment purchases, businesses can preserve their cash flow for other operational expenses.

– Flexible payment options: Equipment financing offers flexible payment terms tailored to the business’s cash flow, with options for fixed or variable interest rates.

– Tax advantages: Depending on the financing structure, businesses may be eligible for tax deductions or credits on equipment financing payments.

– Access to the latest technology: Equipment financing allows businesses to acquire the latest equipment and technology without incurring the full upfront cost.

4. What factors determine the cost of equipment financing?

The cost of equipment financing depends on various factors, including:

– Creditworthiness: Lenders consider the business’s credit history, financial stability, and ability to repay the loan or lease.

– Interest rates: The interest rate on equipment financing may be fixed or variable and is influenced by market conditions and the borrower’s credit profile.

– Loan term: The length of the loan or lease term affects the total cost of financing, with longer terms typically resulting in lower monthly payments but higher overall costs.

5. Are there down payment requirements for equipment financing?

Down payment requirements for equipment financing vary depending on the lender, the equipment being financed, and the borrower’s creditworthiness. While some lenders may require a down payment, others offer 100% financing options with no money down.

6. What happens if I default on equipment financing payments?

Defaulting on equipment financing payments can have serious consequences, including repossession of the equipment by the lender. Additionally, defaulting can damage the business’s credit score and may result in legal action by the lender to recover the outstanding debt.

7. Can equipment financing be used for upgrades or expansions?

Yes, equipment financing can be used to finance equipment upgrades, expansions, or replacements. Whether the business is looking to add new services, expand its capacity, or replace outdated equipment, equipment financing provides a flexible funding solution.

8. How do I apply for equipment financing?

How to apply for equipment financing for auto repair and body shop owners can contactLiberty Capital Group, Inc. that specialize in Equipment Financing for their industry. The application process typically involves providing financial documents, such as tax returns and bank statements, as well as details about the equipment to be financed.

Conclusion

Equipment financing is a valuable tool for auto repair and body shops looking to acquire the equipment they need to operate and grow their businesses. By understanding the basics of equipment financing and exploring available options, businesses can make informed decisions to support their success.