Feb

15

Financing a Small Business

Financing a Small Business

When Financing a Small Business entrepreneurs starting new businesses and existing business owners quickly learn that maintaining sufficient capital is the most crucial element of success. Having a great idea, working long hours, or a surefire group of anxious customers doesn’t matter if an owner can’t pay expenses when they come due or invest in the equipment and people needed to exploit an opportunity. According to SCORE, the SBA’s consulting affiliate, 82% of small businesses fail due to cash flow problems, noting that “cash flow problems are almost like death and taxes. You’re never going to escape them.”

Billion-dollar companies face the same pressures but learn to manage their cash needs through periodic equity sales and borrowing. Similar strategies are available to smaller businesses. Business owners typically seek additional capital amid a cash crunch when they are least likely to be successful. They fail to realize that the most likely time to receive new funding is when they don’t need it.

Anticipating a company’s future cash needs and understanding the sources and requirements of equity and borrowed funds are keys to long-term business success. Managing the financial side of a company is critical for ensuring that sufficient cash is available when needed.

Equity or Debt

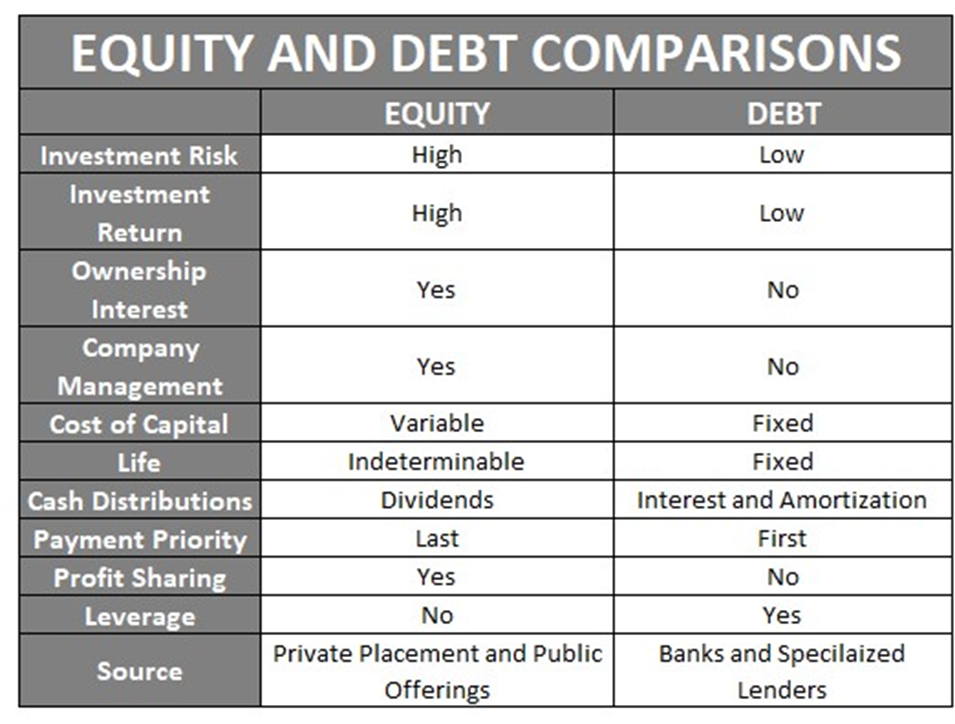

Funds in a business are either “equity” or “debt.” Equity holders earn 100% of any business profits, though the amount of future earnings is unknown. Conversely, lenders receive a negotiated rate of return- interest – independent of profits:

- Equity is the foundation of a company’s financial base. Investors exchange cash for ownership in a business with the motive of financial return by receiving a share of company profits. Earnings of the business are either returned to investors in the form of dividends or kept in the company and added to the equity base (theoretically increasing the value of equity in the company’s market price). Equity does not require repayment, but owners may lose their entire investment if the business fails.

- Debt is money borrowed by the business from a third party. In return for the use of their money, lenders receive a fixed rate of return on their loans. The terms of debt are flexible and contingent on negotiation between the borrower and lender. Debt is either secured or unsecured. A pledge of specific company tangible assets collateralizes secured debt. If the borrower fails to repay the loan, the lender can foreclose on the collateral. The borrower’s promise of repayment is the only collateral for unsecured debt.

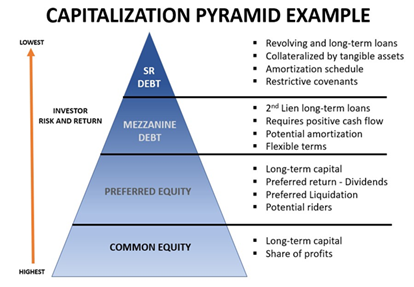

Companies usually maintain a combination of equity and debt in a capital structure resembling a pyramid. Equity lies at the structure’s base with upper tiers of less permanent capital, as illustrated by the diagram.

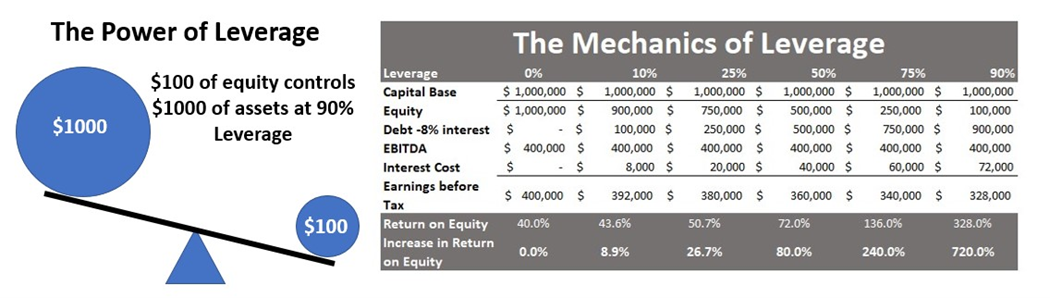

The Advantage of “Leverage”

The ratio of debt to capital is “leverage.” Dividing long-term debt by total capital, i.e., long-term debt plus equity – Capitalization ratio = long-term debt/long-term debt + equity – calculates the percentage of debt to total capital. A business with long-term debt of $500,000 and equity of $500,000 has a capitalization ratio of 50%. Leverage is beneficial when the return on investment (ROI) is greater than the cost of debt. The following examples assume an 8% interest rate and an EBITDA of $400,000. Using debt can significantly boost Return on Equity.

Sources of Equity Funds

Founders of companies often rely on savings or credit cards to start a company. Friends and family typically provide additional equity in a business, motivated as much by their relationship with the founder as by the business prospects of future success. Third parties, including angel investors and venture capital funds, are potential equity investors as the company grows but have high information requirements and hurdle rates.

Federal and State authorities regulate raising investment funds from the public so that compliance with full disclosure requirements is often expensive and bureaucratic, delaying receipt of funds for extended periods. Failure to comply with securities law can lead to civil and criminal charges.

Sources – Debt

Borrowing funds is less complicated and time-consuming than seeking equity. The borrowed funds are often less expensive than giving up equity and sharing control with other investors. In most cases, interest paid on a business loan is deductible for tax purposes. Sources of loans include

- Small Business Administration. The SBA offers a variety of lending programs, ranging from micro-loans (up to $5,000) to fixed-rate amortized loans (up to $5 million). Application for SBA loans requires substantial documentation, including personal financial statements, business financial statements, income tax returns, resumes, and a business overview. Borrowers personally guarantee loans. SBA-approved lenders facilitate the application, underwriting, approval, funding, and administration of loans. The process from application to funding can extend for up to six months.

- Federal and State banks. Traditional banks are the most familiar source of personal and business loans. The Federal Reserve System and the Federal Deposit Insurance Corporation regulate American banks. Loan availability varies from bank to bank based on their financial condition, targeted customer segments, and the economy, so many borrowers have difficulty getting approval.

- Non-bank specialized lenders. Non-bank private lenders, including leasing companies, are most active in short-term, higher-risk loans and borrowers with limited or poor credit ratings. Required documentation is generally less than in traditional banks with faster loan approvals. These lenders typically offer a variety of customized personal and business loans to meet borrower needs.

Final Thoughts

Non-bank lenders have the flexibility to tailor loans to fit borrower needs. For example, a company with a short-term cash flow deficit may elect to:

- Factortheir receivables.

- Borrowshort-term using their receivables and inventory as collateral.

- Get a merchant cash advance.

Applications are usually online, with loan approvals within 3-5 days (In some cases, funding is within 24 hours of receipt of applications.

Astute business owners realize that the best time to seek borrowed funds is before you need them. The combination of online application, limited documents, and quick approval and funding for various business purposes make borrowing funds a no-brainer. Prepare for tomorrow today.