Mar

3

Small Business Lending: Personal Guarantees and UCC Filings

Starting and managing a successful small business is incredibly difficult. According to the Small Business Administration (SBA), almost one-half of new companies fail during their first five years of operation. Unsurprisingly, entrepreneurs require exceptional levels of tenacity, optimism, and faith—the ability to see beyond what is to what can be usually require a pair of rose-colored glasses.

When cash flow problems arise, companies turn to lenders for funds to cover the deficits or invest in the future. Unfortunately, they are rarely prepared for the loan application experience and misunderstand potential lenders’ motives, requirements, and processes.

Equity vs. Debt: Owners vs. Lenders

Equity is the combined investment of company owners who reap the benefits of success and bear the risk of loss. Their investment is permanent capital, recoverable by a distribution of profits, i.e., dividends or increases in asset value upon a sale.

Debt is temporary capital, capital borrowed (loans) used for specific purposes. Providers of debt – lenders – do not benefit from profits nor share the risk of loss. Their return is a regular cash distribution based on a negotiated interest rate and the repayment of the principal amounts of their loans.

The distinction between investors and lenders is vast. Investors seek a continuous, growing stream of profits; they are willing to accept the risk that their investment will be lost. Innovative products and aggressive projections of revenues and profits influence investors.

Lenders seek a negotiated return on the use of their capital and prioritize repayment of the loaned amount. Their priority is ensuring that their loans are repaid as agreed. They look for a solid business case with realistic, if not conservative, financial projections.

Lenders observe a company’s activities while investors participate in the company. Emotions drive investment decisions, while lending is a logical decision. Investors tend to agree with an owner’s perception that “their baby is beautiful.” Conversely, lenders typically identify flaws and challenge opinion with reality.

The Lenders’ Perspective

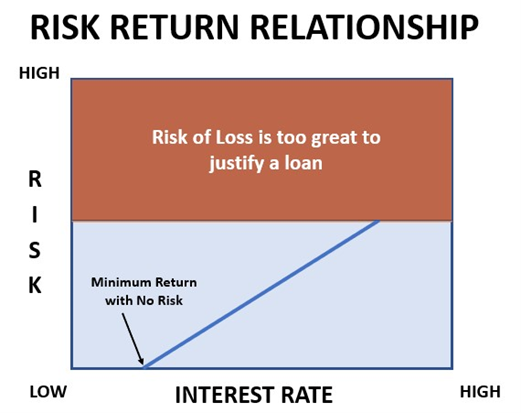

All lenders share a common objective: repayment of the loan principal and a financial return high enough to compensate for the risk of non-payment. Borrowers do not always repay loans, sometimes for events beyond the borrower’s control. For example, lenders are especially aware of the risk of inflation due to recent history, so a dollar repaid in the future has less value than the dollar loaned in the present.

Lenders evaluate and manage their risk of loss by a combination of safeguards – pledged collateral, personal guarantees, and amortization schedules – before setting an interest rate to compensate for the assumed risk, i.e., the greater the risk, the higher the required return. Sometimes, the perceived risk is too high to justify a loan.

Business Credit, Personal Guarantees, and UCC Filings

First-time borrowers are often confused and angry about personal guarantees and UCC filings accompanying business loans. They assume that a business corporation or LLC can readily borrow funds on a simple promise to repay, especially if the business has previously established business credit. Understanding the differences and relationships between business credit, personal guarantees, and UCC filings before applying for a loan will avoid controversy and facilitate loan application processing.

Business Credit

Business credit is the ability to buy today and pay tomorrow. Most businesses simultaneously extend and use credit through credit cards, customer invoices, and vendor payments. Cash flow management is coordinating the sources and uses of credit.

Businesses typically set a limit on the amount of credit they extend with minimum security. For example, some finance companies issue credit cards with minimum documentation, a maximum charge limit of $500 or $1000, and a high interest rate. They understand that some borrowers will not pay and limit their risk by limiting the funds available to the borrower.

Having existing business credit does not guarantee that additional funds will be available nor the absence of personal guarantees or pledges of collateral in the future. Experienced borrowers understand that credit markets constantly change, and new risks accompany each change.

Lenders Personal Guarantees

A personal guarantee is a promise made by a person or an organization to accept responsibility for a third party’s repayment of a debt if the borrower fails to meet their obligation under the terms of the loan agreement.

Corporations and limited liability companies legally shield shareholders from the organization’s obligations in most cases, including repayment of corporate debt. Since small businesses typically lack sufficient collateral or value to justify an extension of credit, lenders usually require owners to guarantee repayment if the business entity fails to meet its obligation.

A personal guarantee extends joint and several liabilities for the debt so that the lender can pursue either party – the borrowing company or the person providing the security – if the loan agreement terms are not met. A personal guarantee means that if the borrower declares bankruptcy and is discharged from debt responsibility, the guarantor is still liable for its repayment.

Most small business lenders require personal guarantees to reduce the risk of nonpayment and eliminate legal or regulatory hurdles that might complicate collection efforts. For example, corporate credit cards issued to small businesses usually require the company and the person receiving the card to accept personal responsibility for the debt.

UCC Filings

State law regulates most business transactions, with most states relying on a version of the Uniform Commercial Code (UCC). A UCC filing is a legal form that notifies the public that a lender has a claim, i.e., a lien, against specific physical property of a borrower in the home state of the business. In the event of the borrower’s default, the lender can foreclose on the property and sell it for repayment.

Dates of UCC filings establish the priority of payments among lenders secured by the same collateral. The UCC filing remains in place until the lender removes the filing or it expires (usually in five years)

UCC filings generally appear on a business credit report, though they do not usually affect the company’s credit score. However, they may affect future qualification for new loans, mainly if the same assets are collateral for new debt. Lenders are generally reluctant to take subordinate positions on pledged assets.

Final Word

Many small business owners treat lenders as adversaries trying to exploit borrowers unfairly. Others consider them “incompetent,” unable to recognize the actual value of an upcoming business. They are neither. A lender’s objectives are no different from the goals of a small business owner: growth and profitability.

Successful small businesses must produce a product at a price that generates a profit and attracts buyers. Lenders must create loans that are repaid and priced to attract borrowers. Nobody wins when a loan is turned down.

Small business owners who come to lenders without prescribed solutions to cash flow needs are more likely to be successful than not. Lenders have multiple options to solve a small business cash flow problem. Working together may produce an acceptable solution for all.