Nov

27

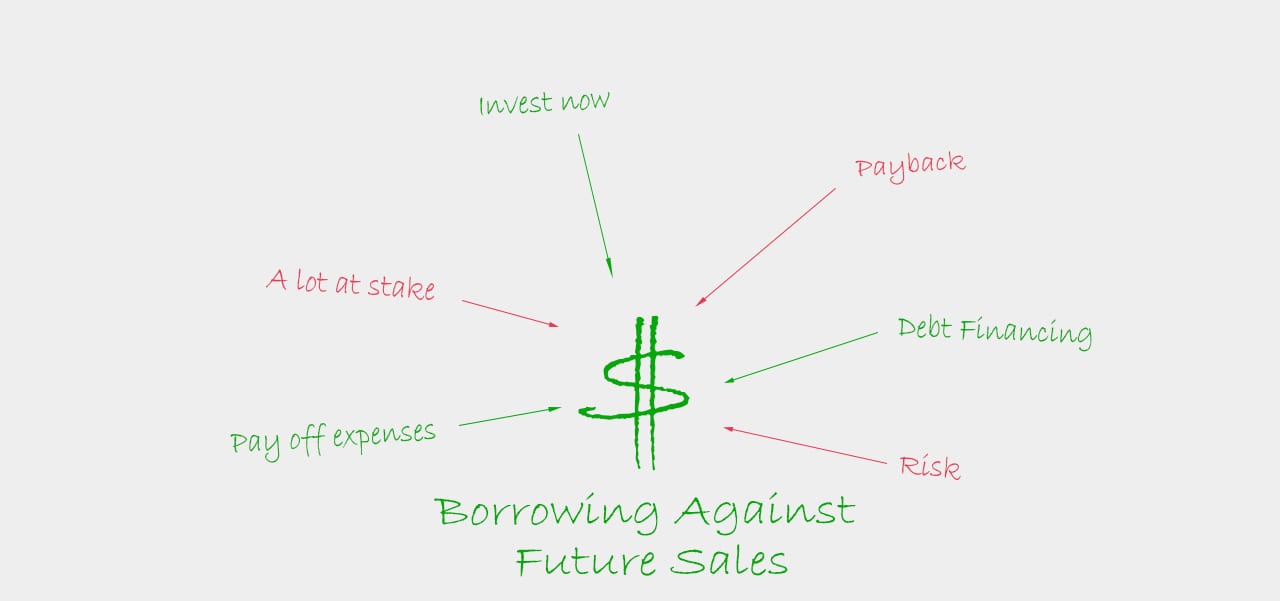

Advantages and Disadvantages of Borrowing Against Future Sales

In a business, being profitable is not enough. You also need to have a positive cash flow, i.e., have more money coming in than going out. This is because a negative cash flow will render you incapable of paying your expenses. However, since revenues are generally generated either at a

Nov

24

Can a Business with Income Loss Still Borrow?

Incurring income loss in a business is not a unique phenomenon. It is quite common for startups and new businesses to face losses in the short run before they are able to grow. However, income losses are not merely limited to small businesses. Many large and well-established firms also find

Nov

23

How Easy Is It to Access a Business Line of Credit?

There are many choices available for people who are looking forward to borrowing money. Borrowers can go to banks and other lenders to get their requested amount of loan based on some terms and agreement. Business line of credit is one such option, but it is not as common as

Nov

23

Invoice Factoring vs Merchant Cash Advance

Invoice factoring and merchant cash advance methods are used as business alternatives when a simple and quick process of funding and financing is required. These methods have fewer documentation requirements and process the application faster as compared to other traditional methods. Small business owners are going for these methods these

Nov

22

Is a Merchant Cash Advance a Good Source of Business Funding?

A small business owner will definitely come to a point where they will require a high amount of capital for further growth. At such times, the merchant cash advance might seem like the best deal available. However, this is when one should consider whether the option of a merchant cash

Nov

22

Top 10 Business Credit Cards for Low Credit

Top 10 Business Credit Cards for Low Credit Managing daily expenditures is a difficult task, especially if you own a business. One of the best ways to have good control over your expenditures is by benefiting from a business credit card. Using a reliable business credit card will allow you

Nov

22

Short Term Loans vs Long Term Loans

What’s Suitable for Small Businesses? A short-term business loan offers a company with access to capital in a very short period. A long-term loan is a detailed procedure and involves repayment terms for long-term financing needs. Most small businesses go for short-term loans because this option is suitable for more

Nov

22

Small Business Profit and Loss

Your Profit and Loss and Balance Sheets Are More Important Than You Think Within any business, there are certain plans and documents that need to be followed. The small business profit and loss table and balance sheet contribute to being one of the most important financial documents in any organization.

Oct

18

Small Business Owners

5 Crucial Things Small Business Owners Do That Harm Their Businesses! Statistics show that more than 20 percent of the small businesses do not make it past the first year. More do not make it past three years and very few go past the five-year mark by which time they

Oct

16

Business Tax Deductions 2017

Best Business Tax Deductibles For Business Owners Before Trumps Tax Proposal! What is the difference between using purchased and leased equipment for a small business? Well, when you lease equipment, you have the chance to lease when you need it only. When you buy, it is yours for keeps. But