Business Hardware

- Very important for business success

- Increase your business efficiency

Business Office Machinery and Hardware Equipment

Certain businesses conduct day-to-day business operations with hardware and some with software. No matter whether your business need is for hardware or software we are able to finance these as business essential equipment.

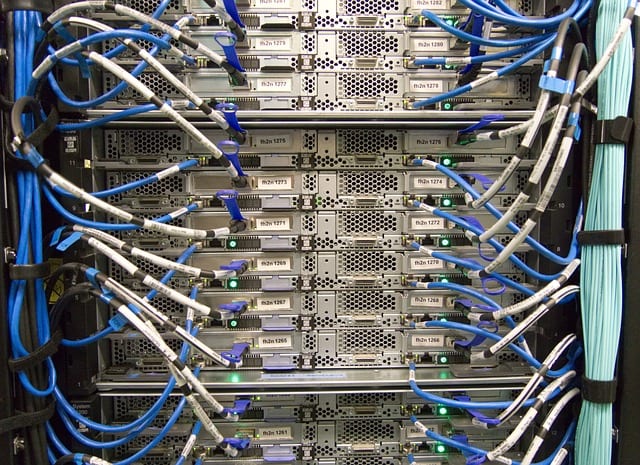

For many, you wouldn’t think you can finance servers, computers, printers 3d printers, lathes, and CNC machiner and many more are all very important for business success who depends on these types of equipment.

Therefore, it’s critical to maintain a relationship with a lender who can provide funding for all your needs now and in the future. However, just as it is with software, these become obsolete fast. Thus, you do not want to sink all of your capital into machines that will become useless in a few years’ time.

When looking for hardware loans, you will find that computer hardware loans are the most popular. However, these do sometimes fall under the office outfitting loans. Computers and Servers could get expensive. So the best way small businesses always require a way to offset some of the profits.

Call us to find out. Let us know the entire project we can finance including installation, delivery, & taxes with a 90-day deferral equipment leasing program.

Call us 619-695-1244!

Covers many types of business hardware

The hardware loan search process

So the first thing you will want to do is find out where you can get this loan. By starting your search for the best business hardware loans here on Liberty Capital Group, you will go through a sort of “prequalification” process that enhances your chances of getting the loan when you apply with the actual lender.

You can see the funding programs that different lenders make available to you. You can then choose beforehand whether these meet your loan needs and goals. You also need to know what a hardware loan entails.

A hardware loan for computers means that you get funding to buy the physical computers, monitors, keyboards, mouses, mainframe computers, onsite servers, cabling and terminals and other related hardware. Currently, it is difficult for you to do business without a computer. This means that you will either have to dip into the capital that you have set aside for your business to buy some or eat into the profit that you should be plowing back into your business.

What a computer hardware loan does is that it gives you more leeway to grow your business. It is a loan and it will cost you money, as you will have to pay it with interest, but at the same time, it leaves you with more money to do business with.

Sometimes, it makes more business sense to lease hardware than to buy. For example, mainframe computers can be very expensive. Servers can also be expensive to buy as well as to maintain. Thankfully, Liberty Capital Group brings you lenders that are not only ready to lend you hardware loans, but are ready to finance leased equipment as well.

Requirements for hardware loan

Okay, you could get a loan, but then it would be too expensive and could come with stringent terms. So it is prudent to run your business for some time and then start looking for funding.

To qualify for an SBA loan, you are required to have been in business for at least two years. The SBA loan that you could use for financing your computer hardware needs is the CDC/504 loan that costs between 3.96% to 4.43%.

SBA loans will also require you to have a personal credit score of at least 680. However, there are other lenders are ready to fund your business hardware needs even when you have bad credit. However, such a loan will be costlier, but it is much better than no loan at all. At Liberty Capital Group, there are lenders to cater to all types of borrowers.

Since this is a loan, the lender needs one thing before all the others- proof that your business can pay loans. Thus, at Liberty Capital Group, we advise you to establish lines of credit with other businesses and insist that any time you pay them, they report the payments to the credit bureaus. If you can avoid it, do not pay suppliers by cash.

Pay them with a business credit card so that the payment can be picked up by the credit bureaus. When you apply for a loan, the first thing the lender will do is ask for your credit report from the credit reporting agencies to see whether you have any credit history.

It takes some time to establish credit history and the sooner you open the lines of credit the better. Can your business be regarded as creditworthy?

Short term or long term?

This is the first consideration that most business people think about when they are looking for a computer hardware loan. Lenders offer both options. From as short as 12 months for the loan repayment to paying in a term as long as 10 years, perhaps longer, you get to choose what suits your needs best. The long-term loan may be costlier as it factors in depreciation and the period of course.

But a long-term loan also has its benefits. One of them is that you can write off the depreciation and save your business some tax money since you will be able to write off the depreciation.

Finally…

A computer loan is specifically designed for purchasing computers. As such, there may be no room to purchase anything else. However, some lenders may allow you through a written agreement to purchase related items.

Is the loan secured or unsecured? There are both types of loans but secured is much better because it is cheaper, it is easier to get. Unsecured loans may be harder to get and will be costlier.