Jun

8

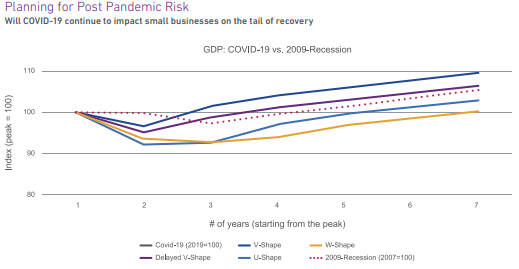

Post-Pandemic Business Expansion

Post-Pandemic crisis arises

Q4 saw rising virus cases in the United States, and stricter containment measures to match in many parts of the country. However, these measures failed to bring about a major rise in both delinquency and bankruptcy, as experienced earlier from large-scale state and national lockdowns. Higher delinquency rates are expected as pandemic support programs expire, yet small business bankruptcy is not expected to rise due to government stimulus, resulting in strong ongoing credit levels.

Rising Labor cost yet unrealized

The labor market remains the clearest source of trouble for the economy. December employment declined and was likely weak in January as well. Employment remains down by 10 million from its peak prior to the pandemic. Though the baseline forecast calls for an average of 341,000 jobs added per month over the course of the year, employment won’t return to its pre-pandemic level until 2023, according to Experian.

With a tight labor market prior to COVID-19, most small businesses reported that their biggest issue was available labor rather than taxes. After the election of President Biden, however, concerns about taxes began to rise steadily, and following the election, more small businesses state that taxes are the largest issue. This trend is expected to continue into 2021, especially up until April 15th.

Every business will now have to deal with the new business cycle, an unfamiliar pattern: small businesses take out lines of credit to increase their hiring, production, or operations through the most lucrative months of the year knowing recovery is on the way. The government stimulus, which no doubt helped many small businesses avoid bankruptcy but the impact still unknown. History will tell us that all was perhaps a distraction rather than a true intent to help not just the economy but those who were affected the most. Most of this stimulus slipped through some undeserving hands from organized crimes to an international professional scammer. In 2020, the pandemic affected many things, including this business pattern, with both borrowing and hiring increasing. But for business reality will hit soon when the cost to operate a business that it’s becoming a barrier to entry further detach the less fortunate from the American dream.

- Moderately delinquent balances for small businesses fell to 1.21 percent in the 4th quarter

- This compares with a 1.60 percentage rate from a year earlier