Jan

16

Last Chance to Recover ERC Tax Credit

Last Chance to Recover ERC Tax Credit

ERC Tax Credit: The first case of Covid-19 emerged near Seattle, Washington, on January 19, 2020. By the end of March, State and local governments had declared a state of emergency that included stay-at-home orders and closures of schools, daycares, bars, restaurants, and non-essential retail. According to the U.S. Bureau of Economic Analysis, the U.S. Gross Domestic Product (GDP) fell 31.7% in the second quarter of 2020. Small businesses were especially hit, losing billions of dollars and more than one-third closing permanently.

Passage of the Employee Retention Credit (ERC)

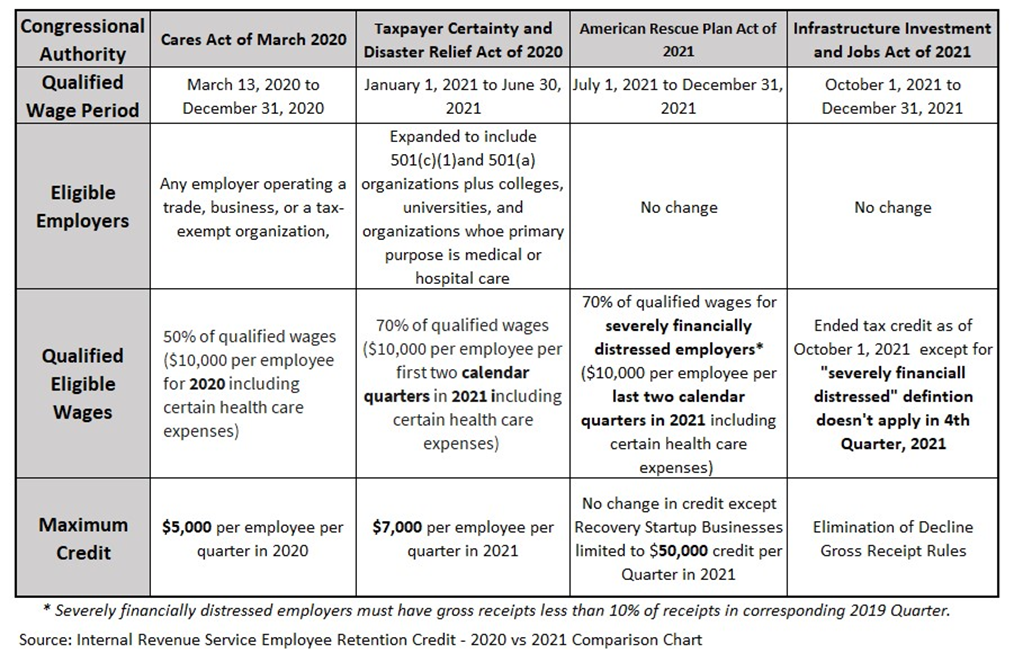

Congress passed the Coronavirus Aid, Relief and Economic Security (CARES) Act in March 2020 to help small employers weather the pandemic. The Act created the Paycheck Protection Program – a program of Federal loans for small businesses to maintain payroll – and the Employee Retention Credit, a payroll tax credit. The credit was subsequently amended three times by the Taxpayer Certainty and Disaster Relief Act of 2020, the American Rescue Plan Act of 2021, and the Infrastructure and Investment Jobs Act of 2021.

ERC Cash Benefits for Small Business Owners

The ERC tax credit is refundable, i.e., the government returns excess payroll taxes to the employer. The refund encouraged companies to maintain employment despite the drop in business revenues. The credit equaled 50% of “qualified wages” up to a maximum of $20,000 per employee in 2020. It was raised to 70% of qualified wages up to $ 10,000 per quarter in 2021 and the first three quarters of 2022.

In 2010, the Federal Government passed the Plain Writing Act, intended to simplify government-speak and improve understanding of its laws and rules. Unfortunately, agencies like the IRS did not get the message. The explanation of businesses eligible for the ERC tax credit and calculating the credit amount is simultaneously confusing and complex.

Unclaimed ERC Funds

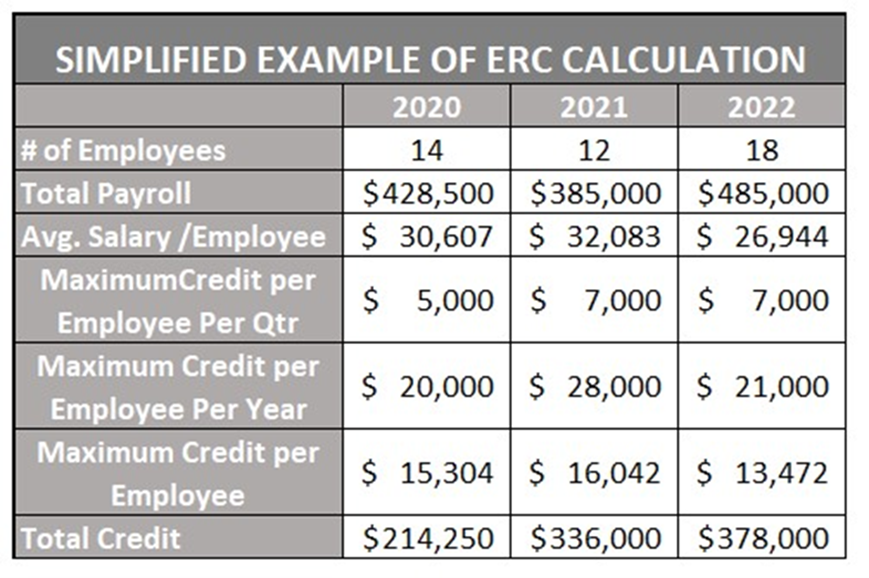

According to the National Federation of Independent Business, only 10% of small businesses claimed the ERC in 2020; only 8% claimed the credit the following year (2021).[i] Many small businesses have not claimed the credit simply because the many ERC credit rules and regulations make it near impossible to figure out the amount available or how to apply for the credit. Nevertheless, the potential funds available justify a renewed attempt to qualify. The following table – a simplified version of a fictional company eligible for the ERC tax credit – illustrates the possible cash rebates for a small business:

The ERC tax credit ended on September 30, 2021. However, eligible companies can request the credit retroactively by amending Employer Quarterly Tax Returns (Form 941-X) for the past 2020, 2021, and 2022 quarters.

Typical Questions about the ERC Tax Credit

Who is eligible for the ERC Credit? (check eligibility)

Eligible small businesses and tax-exempt employers include those whose operations were

- curtailed during 2020 or 2021 due to government Covid-19 orders, or

- experienced a significant decline (20%) in gross receipts during the calendar quarter compared to the same quarter in 2019.

Additionally, any business starting up after February 15, 2020, with less than $1 million of sales is also eligible in some cases.

How much is the Employee Retention Credit?

Depending on the year incurred, eligible employers can receive up to $10,000 per employee per quarter based on 50% of qualified wages and healthcare expenses in 2020 or 70% of qualified wages and healthcare expenses in 2021.

Is a business eligible for ERC if it participated in the PPP?

Yes, though a company that received PPP funds was not eligible for the ERC initially. The Consolidated Appropriations Act of 2021 removed the restriction retroactively to 2020.

Can a closed business apply for the ERC?

Depending upon the circumstances and the closure date, the business may qualify for a retroactive ERC tax credit. Claiming a retroactive payment requires refiling past Employer Quarterly Tax Returns.

Is it too late to claim the ERC Tax Credit?

No, it’s not too late! ERC Specialist is a good place to start. Although the ERC has expired, eligible businesses can claim the credit retroactively by filing an amended 941-X payroll tax return. The statute of limitation extends three years from the original filing date of the return. For example, a claim for the first quarter of 2021 must be filed by the end of the first quarter of 2024. Similarly, a claim for the second quarter of 2021 is allowed until the end of the second quarter of 2024, and so on.

Is the ERC a loan, i.e., repayment required?

No. The IRS treats the ERC as reimbursement of employer payroll taxes paid or due during 2020 or 2021. It is refundable, so the amount is paid in cash, similar to an income tax refund. Repayment is not required. However, you can get business term loan to match the time frame of the refund if you desire to access capital today utilizing time value of money…

While the credit is not taxable to the employer, the credit may affect previous salary and wage deductions, indirectly increasing the income tax owed for the period. Filers should be aware that additional filings and payments may be required, though generally less than the refunded credit amount.

Can my bookkeeper or CPA file the necessary documents for the credit?

Yes, since no legal or professional qualifications or requirements are necessary to file employer reports with the IRS. Nevertheless, a thorough knowledge of the applicable laws and regulations regarding Employee Retention Credit is essential. Consequently, company owners often prefer the services of a consultant specializing in small business tax legislation like ERC Specialists.

Certified Public Accountants (CPAs) are typically concerned with accurate accounting records and systems with less emphasis on tax matters (though some CPAs and attorneys specialize in taxes). Similarly, company accountants and bookkeepers focus on day-to-day recordkeeping and reporting. They may lack the specialized knowledge required to evaluate an ERC application accurately.

What does it cost to use an expert for filing a claim?

The costs of determining whether a company is eligible for the tax credit or providing services necessary to collect and properly file an application vary according to the filing agents. CPAs, attorneys, and public accountants typically charge an hourly fee based on their experience and firm size. For example, A partner or manager with one of the Big Four public accounting firms – Arthur Andersen, Coopers & Lybrand, Ernst & Young, and KPMG – could charge $500 an hour or more. Local and regional firm personnel typically bill at $150 to $200 per hour.

Firms such as ERC Specialists do not charge for an initial review of company records to determine if their client qualifies for the credit. However, such firms usually charge a contingency fee equal to a specified percentage (10%-20%) of the cash benefit received. The cost is not due until the client gets the IRS cash credit.

Final Thoughts

Operating a small business is difficult in the best of times and almost impossible in periods like 2020 and 2021. In 2018, the Small Business Administration estimated that only half of small businesses survive five years, typically because they run out of funds.[ii] Many small businesses struggle to recover from the pandemic and are likely to face a recession this year or the next.[iii] Having extra funds from refiling for the ERC will be beneficial in the coming months, possibly the difference between closing the doors permanently or continuing to operate.

——————————-

[i] Staff. (2021) Latest NFIB COVID-19 Survey: Half of Small Employers Report Supply Chain Disruptions Are Significantly Impacting Their Businesses. NFIB & Small Business Press Release. (September 15, 2021) https://www.nfib.com/content/press-release/coronavirus/latest-nfib-covid-19-survey-half-of-small-employers-report-supply-chain-disruptions-are-significantly-impacting-their-businesses/

[ii] Otar, C. (2018) What Percentage Of Small Businesses Fail — And How Can You Avoid Being One Of Them? Forbes magazine. (October 25, 2018) What Percentage Of Small Businesses Fail — And How Can You Avoid Being One Of Them? (forbes.com)

[iii] Golle, V. and Yoo, K. (2022) Economists Place 70% Chance for U.S. Recession in 2023. Bloomberg News. (December 20, 2022) Economists Place 70% Chance for U.S. Recession in 2023 – Bloomberg