Jan

18

Business Funding and Credit Score for 2013

“What is a good credit score?” Typically each year funding sources seem to change the scoring parameters to reflect previous year’s performance. In an “App Only” transaction which means no financials or tax returns required for approval, a low consumer credit score can be a deciding factor, particularly in small ticket transactions, as well as in larger transactions.

In actuality, the credit score depends on the type of financing, the effective yield to the “lender,” as well as collateral or relationship. One lender may consider 650 a very good score where another wants it at least 700. And there are those who won’t go below 650 and to subprime, 550 is the turn down number.

Some lenders will have a wider credit window but rates will commensurate with the score. These are generally considered the criteria:

760 – 850 = excellent credit

700 – 759 = great credit

660 – 699 = good credit

620 – 659 = fair credit

580 – 619 = poor credit

580 and below = very poor

Many still rely on FICO (Fair Isaac scoring), which is similar to what the average for 2012 was determined:

760-850 = Great

725-759 = Very Good

660-724 = Good

560-659 = Not Good

300-559 = Bad

Multiple inquiries will lower a score, so often shopping for the best rate may hinder chances, as many creditors believe the more inquiries, something they don’t like or the applicant has taken out too much debt, especially not disclosed or appearing in balance sheet.

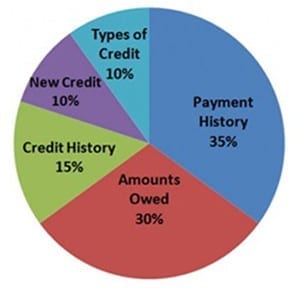

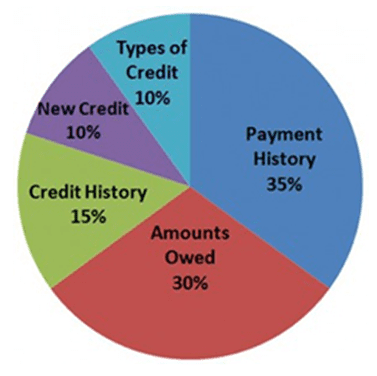

Here is what Myfico.com says influences credit scores:

For some form of business funding, bank balances, trade references, financial statements and tax returns are as important as the consumer credit score of the business owner, especially for some form of business funding in the world of automated scoring system, a better credit score will get you a faster approval and funding.

A few important information about Liberty Capital’s business working capital program notes:

- Below 600 FICO constitutes more than half our funded merchants

- We will consider business types that are restricted including law firms, limousine services, furniture stores and highly seasonal business (such as landscapers)

- Bankruptcy, Liens & Judgments do not disqualify your business– provide proof of agreed upon plan & that you’re current with the tax authority

- We do not require a business owners to maintain a certain minimum bank balance amount (except 15 overdrafts in a month 2 months in a row)

- Don’t require tax returns or financial statements for approval

- Unlike many providers we do start ups

- Liberty Capital don’t ask for application fees

With Liberty Capital, credit score isn’t a factor when accessing working capital for any type of business. We have sources for small to medium size businesses for unsecured business working capital for up to $10k to $500k per location without additional asset as collateral. We can fund in days not week or months.