Feb

3

Borrowers cant always get what they want

Borrowers cant always get what they want

Borrowers cant always get what they want: In 1968 before a live audience in London, Mick Jagger of the Rolling Stones band sang about a hard truth in life. Most people discover in early childhood that what we get is often different than what we want. Children often believe that their thoughts can directly cause things to happen. By the age of seven, people typically abandon “magical thinking,” the belief that expectations influence outcomes. They recognize that actions, not thoughts, influence outcomes. Whoever initially said, “the harder I work, the luckier I get,” stated a fundamental truth. Preparation, not expectations, leads to success, whether winning a race or borrowing money.

History of Business Lending

Approximately 4,000 years ago, farmers were the first to borrow money to cover their living expenses until selling their crops or livestock. The Babylonian Code of Hammurabi (circa 1792-1750 BCE) was the first legal code dealing with debt. Since that beginning, the nature of debt – its security and costs – evolved into an extensive range of loan types offered by a wide variety of lenders. Potential borrowers are often unfamiliar with the purpose, options, and limitations of lenders and loan types. As a result, they have unrealistic expectations about the available funds and the lender’s loan requirements. According to one industry index, approximately one-quarter of small business loan applications were funded in 2022, ranging from 14.5% for big banks to 27.6% for alternative lenders.

Borrower Expectations and Reality

Borrowers often have little or no experience with the lending process and resist lenders’ detailed application and underwriting criteria. They typically inflate the value of their business. Potential borrowers usually apply for loans when their cash need is urgent, putting undue pressure on the lenders and the process. Unsurprisingly, small business owners typically apply for business funding without adequate preparation or the flexibility to consider different loan types that may be better suited to their circumstances.

A Variety of Loan Types for Borrowers

In the centuries since the first loans to farmers, lenders have developed multiple loan types to meet the needs of borrowers in different circumstances. A list of popular choices includes:

- Traditional business loans self-liquidating over a definite term,

- Working capital loans intended to supplement cash flow shortages,

- Equipment financing and leasing secured by specific physical assets,

- Merchant cash advances in return for a fixed percentage of future sales,

- Invoice factoring and financing to compensate for slow collections, and

- Lines of credit to ensure cash when needed.

Loans may be collateralized – secured by the pledge of a tangible or intangible asset – or backed solely by the business’ revenues and profits. Interest rates and terms can be fixed or variable. Lenders are masters at aligning the appropriate loan type with the business’s and its owner’s needs.

Factors Lenders Consider in Business Lending

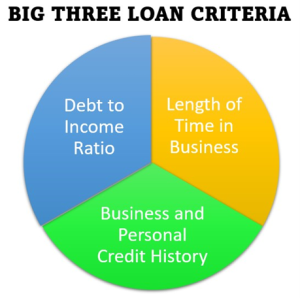

Business owners who ask for a $150,000 loan when their monthly income is $10,000 or a business making $50,000 per month that requests a $500,000 loan are likely to be disappointed. Potential borrowers should know the criteria by which a lending decision rests. While requirements vary by loan type and lender, all lenders consider three main factors when deciding to make a loan:

- Debt to Income Ratio. Lenders seek assurance that the business can repay a loan during its term. A general rule of thumb is a maximum loan amount of 50% to 150% of their monthly average deposits/income. The longer the repayment period, the more funding they can extend, considering all other factors in underwriting. In the example above, a borrower with a $10,000 monthly income should expect a $5,000 to $15,000 loan offer if all other loan factors are favorable.

- Time in Business. Startup businesses are notoriously risky. The Small Business Administration (SBA) reports that almost half of new businesses fail within five years. Lenders look more positively to companies that have been continuously open for multiple years, as their life suggests the owners have experienced multiple operating environments. A year-to-year increase in revenues or profits is another positive factor in the lending decision.

- Credit History. Few small businesses have the history or financial strength to borrow money without the personal guarantees of individual business owners. Lenders will review the credit scores and reports of the company and its owners to gauge the likelihood of repayment. NOTE: Collateralized loans rely less on personal or business credit histories.

Depending On the type of financing sought, lenders may also review business plans, market studies, asset appraisals, and professional credentials. Contrary to the borrower’s belief, comprehensive research indicates that lenders want to make a loan rather than reject it. All lenders seek to avoid the hassle and costs of collection and foreclosure efforts.

Five Keys to a Successful Loan Application

While there are never guarantees about the future, there are steps potential borrowers can take to improve the likelihood of receiving a loan:

- Anticipate your future cash needs. Cash crises rarely occur overnight. In most cases, signs of a coming cash crunch are readily available if we look for them. A decline in sales, an increase in costs, or a lengthening of average collection periods suggest a business is under stress and potentially burning cash. Recognizing that physical assets need replacement or refurbishment and plans to expand into new territories are irregular uses of cash that can create cash needs. Anticipating when a need for debt funding will arise allows a borrower to apply for loans before they need the funds. It is always a good position when borrowing money.

- Clean up your act. Be sure your financial records are available and accurate. If you have a history of defaulting or slow payments to creditors, be prepared with a creditable explanation. Companies that don’t need cash can afford to stretch out payments to maximize cash flow; those depending on external working capital funds need a positive or improving credit history.

- Quantify your need for cash, not your want. Lenders make money from good loans. Consequently, they will seek to loan the maximum amount justified through their underwriting. The amount of funds you “want” is secondary to the funds you are qualified to receive.

- Be flexible. Unless you are a financial expert, let your lender determine the type of loan that best fits your need for cash and ability to repay. Firms like Liberty Capital make hundreds of financings each year. They know the market more thoroughly than a small business owner who occasionally applies for financing. Flexibility does not mean acquiescence; the business owner always has the final sayon whether to accept a loan offer.

- Act professionally. While borrowing money is typically a stressful experience for the borrower, don’t let your emotions get the best of you. Anger, fault-finding, or unreasonableness will not change a lender’s decision but might affect future opportunities. Don’t burn bridges! Lenders are not your enemy but allies on the road to success.

Final Thoughts

A lender’s decision to extend a loan is not personal. Like other business owners who sell goods and services, lenders “sell” the temporary use of their money in return for its repayment and a little more to cover their overhead and earn a profit. The sole concern of a lender is the borrower’s willingness and ability to repay a loan as agreed. A friendly relationship between lender and borrower is welcome but unnecessary to complete the transaction.