Oct

10

Lending Sources To Consider

Small Business Loans Top Lending Sources To Consider

With many small business lending sources to consider, business owners may think that they are spoilt for choice. They may have more options, but credit is credit no matter what.

However, a loan is an expense or an investment, and therefore, before delving into one, you must know the benefits and the disadvantages of a specific type of funding source that suits you and your business need. Before putting your signature on the dotted line, please bear in mind many factors to consider when borrowing for your business whether long-term or short-term capital.

The most important things when looking for a business loan include:

- The type of loan

- The interest rates

- The main features of each loan

- Qualification and Underwriting processes

Here are more details regarding this:

Bank loans

Banks are usually the first choice for many business owners for loans. At one time or another, a business will have to apply thru traditional bank for personal or business related loan activities such auto loan, home loans, credit cards or even student loans but when it comes to business retail banking, most local banks do not have the same funding capacity as National Banks. The bad news is…only 15% of start-ups are accepted by local or traditional banks that most people think of when comes to borrowing.

Now, the most important thing to know is that in this age, slightly more than 20% of all businesses that apply for loans to get approval, so your chance of getting a loan is still high if you meet the underwriting guidelines each lender spit on each applicant.

The bank loan interest rate starts from 5 – 15%! A better credit score can get you better rates, but not lower than 5% for any unsecured funding. Also, know that the bank loan application process can be long, and you will need to secure the loan with collateral. When we say, unsecured would be something like personal loan, term-note. Auto loans, home equity loans typical has a collateral built it in such as the car or the house. For a bank to offer lower than 5% for unsecured is unheard of, but possible for certain high-net-worth clients who just need a bridge loan.

SBA loans

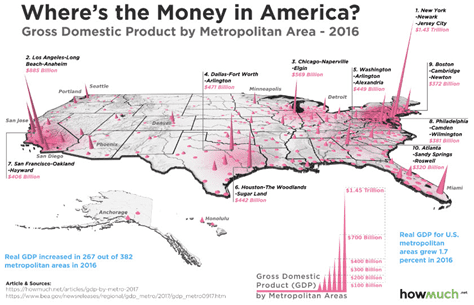

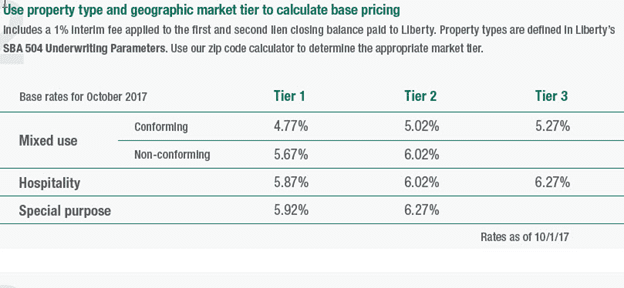

SBA stands for Small Business Administration, a program that was established by the federal government of the USA to help small businesses with loans of any sort for anyone who meets their criteria, to include farmers land purchase and disaster loans during catastrophic even in the business and community. Usually, the interest rate is 6-9% APR (annual percentage rate meaning the amount of money the loan is likely to cost you annually). This is far friendlier than the bank loan. Below image is one sample of the type of SBA published rates for SBA 504.

The SBA loans are offered under programs like:

- Disaster loans – offered to help business owner recover from hurricane, floods and other calamities

- Equipment loans – Used for purchase of equipment and major office furniture

- Real estate loan – Used for purchase or development of real estate. SBA can also help you find Certified Development Companies on their website.

- Microloans – Loan sizes start at $13,000 to $50,000 and are offered to help small businesses expand.

- General loans for small businesses – you can use this money for buying a business or expanding the one you already have.

Does this mean that the SBA agency is going to offer you money? Apparently not, but it will step in as you guarantor to the lenders. This means that should you fail to pay; the SBA will pay the lender the guaranteed portion in case of a default, fraud or plain business and personal hardships.

This means that when you are applying for an SBA loan, you should only look for banks that offer SBA loans. However, the SBA itself does not lend typically, but at a fee, they will help you with loan packaging to get the best chance for an SBA approval. The total loan limit is $2 million, but the figure is always updated, and so as a business owner, you are advised to visit the SBA website frequently to see whether any changes have been affected. As a borrower though, you will have to guarantee the loan with SBA with your personal assets.

The SBA guarantees loan ranges from 50% to 80% of the loan proceed, but typically for a normal non-disaster grant or subsidized loans; they would require collateral and down payment sometimes up to 10-20% of the loan amount.

Yes there are many lending sources to consider, on the SBA website, you can find the list of lending institutions that lend SBA loans. Choose one bank, and it will help you expedite the loan application process.

How does SBA decide to stand in as your guarantor for the small business loan? Mostly, they will look at your cash flow for the past three years. Mostly, they will try to calculate the amount of revenue you have generated over that time from your tax records.

They will also look at your performance record in the worst three years of your business. That way, the SBA assures itself that you can run the business even when going through tough times.

When applying for SBA is not the same applying for any other loans. Not only underwriting is stringent; the process is slow, verification of data submitted requires time and patience. SBA form 480 is a status declaration form that you must complete to be considered in the first place.

According to Small Business Administration, 480 form is explained here:

“This form must be completed by a business concern (“Applicant”) before it can receive financing or consulting and advisory services from a small business investment company licensed by SBA (“Licensee”). The Applicant should complete Part A and Part B (if necessary), sign the Applicant’s certification, and return the form to the Licensee from whom it is seeking assistance. The Licensee should sign the Licensee’s certification and retain the form in its files. Please do not send forms to SBA or to the Office of Management and Budget.”

The best place to apply for SBA is not directly through SBA but to a licensed Lender, SBA approved lender, community developments and many other approved SBA lenders nationwide or locally within your district.

Personal and Business Credit Cards

Offered at an APR of 15 to 16%, or even higher, very convenient and easy to use, credit cards are the choicest way for a business to access funds and at the same time build its credit history and score.

If you choose business credit cards carefully, you will enjoy great incentives. For example, if you travel a lot, get a credit card that offers travel miles. If you drive a lot, get a card that offers cash back on fuel and so on.

The APRs for the credit cards is higher than the interest of the banks. If you are late making your monthly payments, you could also attract steep penalties thus making the debt burden bigger.

Again, the company issuing the credit card may also adjust the rates too high or low depending on your payment history. When you apply for a credit card for your business, you will be personally held liable for the payment.

Keep on top of your credit report so that you can have any errors corrected in time. However, at the same time, know that credit card companies give more protection to personal credit cards than they offer the business cards.

As a business owner, you should take the security of your business and personal credit cards very seriously. Credit cards for business are the most targeted by thieves. At the same time, your staffs who are assigned the cards could end up misusing them. It is your role to make sure the cards are safe and are at the same time; they are used for the purpose that they were acquired.

Peer2Peer and Peer2Business Loans

Peer2Peer lending companies have caused quite a ripple effect in the recent past, but many small businesses have been reluctant to borrow their loans. The main reason is that this is a new lending trend and therefore, many people do not know how it works. Thus they choose to give it some time.

While only 3% of small businesses have come out for the P2P lending, the prospects are looking good. Over the time that P2P lending has been in business, the Lending Club has come out in the frontline as the most established lender with most of the borrowers using the funding to pay their credit card bills.

One thing that most business owners love about P2P lending is that it allows them to access the funds they need at a low-interest rate, then most options in the market offer. These rates are fixed for the agreed payment period. This is why experts are predicting much growth in P2P lending in future.

However, P2P loans also have some disadvantages too. For example, you will have to pitch for the loan publicly, thus baring your business to public scrutiny. If you have just discovered a new service or product, you will have to expose it for all to see.

If you have a low personal credit score, you may also be denied the loan because this is one of the things that the lenders look at. Lastly, the lending will also be influenced by the global economic trends.

The APR for these loans is usually between 5 to 9%.

Invoice Factoring – 28‐60% APR

To factor, an invoice is to sell it to another party at a discount so that they can cash it and recover the money while they give you your money in advance. This means you have sold things, have the invoice ready, but you cannot be paid as fast as you would like.

To get cash on your invoice, you sell it to a lender, but for a price lower than what is on the invoice. Mostly, you can expect to pay an APR of between 28 and 60%, quite high. Other requirements are that the invoice is due for not longer than 90 days and that the people charged in the invoice have a good paying history with you.

Alternative Lenders – 30‐70% APR

As their name suggests, these are most likely the lenders that you go to when all the other options have failed. Their rates are high, starting from 30 to 70% APR but all the same, they do lend your business money.

Businesses with low credit scores that would not be touched by a 10-foot pole by other lenders can benefit from these loans. So can companies that have only been a short time in the market. The loans are processed fast, sometimes within a day. The interest rate is determined by the current market, your personal credit history and score among other factors.

Merchant Cash Advances

This is another source of funding for business owners if you have less perfect FICO score or have a very little asset to pledge as collateral to get traditional term loans. A business owner is advanced a certain amount of money for a percentage of their future credit and debit card sales, invoice, or future sales for up to 24 months. However, typically, payment is not called payment but rather called either remittance, withhold or RTR.

This means that when you get this advance, the lender takes a certain percentage from all the sales, if payment is withheld through ACH, that percentage is converted into fixed amount and ACH daily during business banking hours. The APR is very high for this merchant cash advance, usually because of the unorthodox manner in which you get an advance and the type of business owner profile it attracts. For example, your business or personal credit score does not matter, as much as the other type of business funding, and you are not required to put up any collateral and sometimes without a personal guarantee. The APR is between 80 and 130%. From surface rates are significantly higher than many, but for some with no option, this could be a life saving to get the business to the next level, and this has been more common than ever before due to ease of access to funding.

Personal loans

It is true; you can use personal loans for business. After all, a loan is a loan, and money is money. It does not matter what you use the money for. Which kind of business is more suited to personal loans?

- A new business with no credit history

- A business whose owner has low credit score

The requirements for personal loans are less stringent, unlike the business loans where income is typically combed through thoroughly. In any case, there is no indication that you should only use the personal loan for your individual needs. You can use it for anything that you like.

Traditional banks can grant personal loans, and the alternative lenders can also give them. Lenders usually cap the amount that they can lend to you on a personal basis. The repayment period also differs from lender to another. Mostly, it starts at 3 to 5 years.

The APR for personal loans is determined by the credit score of the borrower, and it is income to debt ratio, but it usually starts at 9.48% to 29.99%. The higher the credit score, the lower the APR you will get with your loan. Once you have your loan, you can invest it in the business.

A personal loan is purely based on personal income and personal credit whereby business loan includes on top of the two mentioned, business revenue, debt and credit to the mix when deciding on a business loan.

Student loans

Most often, people with student loans find it hard to start a business, but it does not have to be that way. Did you know that today, Americans owe the system more than $13 trillion in student loans? That is quite some money now, isn’t it? It is close to the budget of all African countries combined.

However, that is not the question. Whether you can get financing when you have a student loan is the question. Moreover, the answer is yes, but a vague yes. Similar to the personal loan. However, you must be a student and can include family members to guarantee the loan. Obviously, income is not necessary as most students do not have income, but they anticipate and hope upon graduation that an excellent job ensues to be able to fulfill the loan obligations.

Try nonconventional financing options

You can always get nonconventional loans from the lenders coming up all over. Some do not even care whether you have a student loan to pay. Others do not even bother whether you have a good credit score or not. They will give you financing for business, also though it will cost you more.

For you to improve your chances of getting a business loan when you are still servicing your student loan, you should be employed, and start building your credit history. For example, when you have not missed any student loan payment for the last 12 months, you have a credit score of at least 550, lenders will look at your favorably than a person who has been late paying their student loan three times.

Moreover, now the big question is, can you use a student loan to start a business? Apparently yes, as we have learned from many quarters. For example, you can decide to get more student loan money than you need for your education and use the extra to start a business while you are a student.

The main benefit here is that you will pay less interest. Of all loans, the student loan is the cheapest in the market, with APR rates starting from 3.82%. If you defer the payments, the interest rate will be 10.76% at a variable rate and 6.13% fixed rate.

Instead of using your student loan to pay for a comfortable studio apartment, you can use the excess money to start a business. Your entrepreneurial dream should not curtail just because you are in school. Also, the student loan does not place an immediate repayment burden on you.

Another way of finding a business loan when you are a student is through an investor, and the collateral will be part of your business. However, for that to happen, you will have to have an excellent business idea. If you have watched Shark Tank, you know what it means.

Mortgage loans

We all know what mortgage loans are but what many people may not know is that you can use home equity to borrow a loan for the business. This is similar to putting up your home as collateral. Mostly, you will have to take out a second mortgage on your home for renovations and stuff. Your home is the collateral and should you fail to pay; you will lose it.

However, after you are assigned the home equity loan, also referred to as home equity line of credit, you can go on to fund your business with the money. This is best done for a business that is already running, or for a start-up with an excellent service. With more than 20% of businesses going out of business in their first year, and with more than 30% failing in three years, you ought to be very careful.

There are many benefits of using the home equity loan to fund your business. See below:

- It is easy to get the home equity loan – less paperwork and shorter process.

- The interest rates are lower than those charged on a business loan. The lender is taking the house as collateral, and that is not risky at all.

- If you have a good-to-excellent credit score, you can get the home equity loan at very affordable interest rates.

- You do not need a business plan, tax documents, revenue proof and other documents for your home equity loan although you will use it for business.

- You just need three things to get the home equity loan – personal credit score, income and of course equity/house

Taking out an 80% home equity loan will give you good money for your business.

The best types of businesses to fund with the home equity loan include those that do not deal with inventory, which if not bought on time may lose its value. Instead, a service business is most recommended to be funded with the home equity loan. Home equity for business is good for a startup, but once a business has established its footing, home equity should be separated from business to personal and can be used as a last resort. Most companies incorporate but yet they commingle their personal and business financials especially when it comes to taking on debt, risks and liabilities where if the business ever folds you are dragged into it personally.

The APR for home equity line of credit starts at 5.63% to 9.95%. It might be low, but the risk of losing you’re business and personal asset, homes or other belonging is nowhere you want to put yourself in, which will just make it harder and harder for you to recover.

There are many options to access capital from personal credit cards to home equity to business loans, however, the route you go, please be prudent to any risk-taking decision especially for high short-term working capital advance loans that preys on young start-up businesses. However, I do not recommend using the personal investment and resources to fund business ventures, in place of business loans as it might have significant consequences in your future financing endeavor as it might drain your personal net-worth. Angel investors or equity funding would be your other options when the business loan is not working out for you. When none works, try family and friends. When that does not work, get a job, start small and build it out. No matter what route, just be prudent! Good luck!