Nov

22

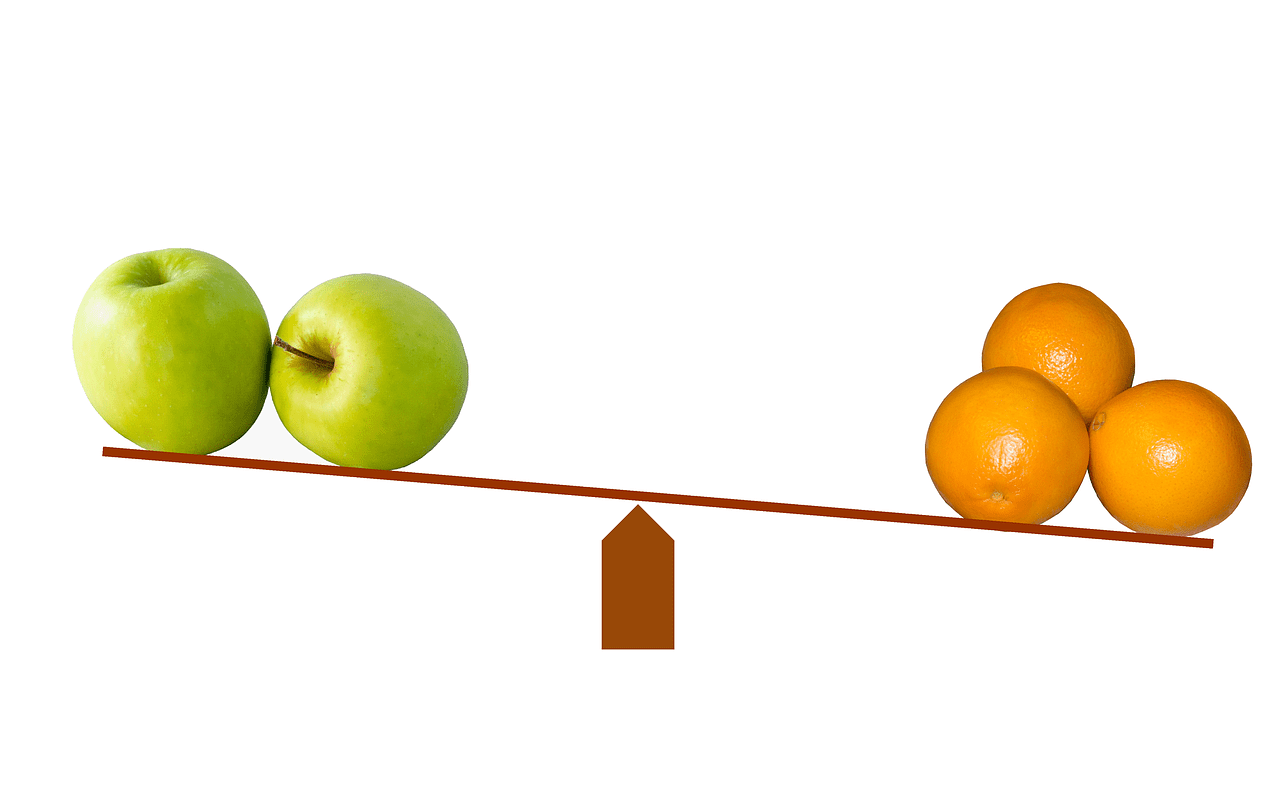

Local Bank vs National Bank for Small Business Owners

For businesses, it is important to consider the flexibility and ease of access provided by the bank, whether it is a local bank or a national bank. As the banking fees are rising, most small business owners are facing difficulty acquiring loans from banks and lenders.

For small business owners, it is always a challenge to obtain funds or finances from big banks such as a national bank. The local or small banks are more flexible and friendly toward small businesses as they don’t have strict rules for applying or qualifying as a candidate.

Local Banks or Community Banks for Small Businesses

Local or community banks are a good option for small businesses because they offer the same services at a lower cost as compared to the national banks. The local banks offer services such as debit and credit cards and online bill payments at lower rates than big banks. The average fees at these banks is lower than the big banks. According to studies, the interest rates offered by local banks is also less and they offer better credit card terms too.

Local banks are used as a funding source by most small businesses. Such businesses don’t consider the option of borrowing from national banks because the big banks have a very small portion of their resources allocated for small businesses, and their qualification and approval process of lending are also very strict.

Most local banks are involved in the betterment of the community and as the community benefits, the local banks also benefit. The main aim of a local bank is to convert the loan into productive investments and other deposits.

National Banks or Big Banks for Small Businesses

Big banks use the latest technologies and are the ones that went digital before the small banks did. These banks offer the necessary addon services for small businesses and are also available everywhere. Though these banks charge more, they offer a variety of services and tools to help small business owners.

Some important and helpful tools offered by national banks to small businesses include treasury services, automatic download to QuickBooks, retail services, payroll services, enhanced security, invoicing, and online tax payments.

As a small business owner, if you don’t mind the high charges, you must choose a big bank as it will provide you with one platform to organize the financial aspect of your business.

However, national banks control more than half of the assets of all the banks and allocate only 18% of their total business loan portfolios to small business owners. Big banks mostly reject the business loan application of small businesses because they have strict rules and regulations and qualification processes. These banks also use investments or a community’s deposits to reinvest in Wall Street or other regions.

Though they allocate a very small portion of their resources for small businesses, they provide good services and tools to them. As a small business owner, if you have a good credit score, you can easily apply for a business loan from a big bank. One thing to keep in mind is that the big banks have many branches and offer easy self-service options such as ATMs. Smaller banks may be prone to errors, but a big bank is more professional at providing services.

In short, big banks offer a convenient funding method to small business owners, provided that they can afford the high charges. The good thing is that these banks have branches or banking relationships with banks in foreign countries as well to help make one’s business more successful.

Which One Is Better for a Small Business?

Local banks are considered as the best option for small businesses because they offer the best business loan opportunities, easy qualification processes, personal interaction, and strong accountability to small business owners.

Another reason for this is that the local banks readily approve business loan applications of small business owners, which the big banks don’t. Even in a situation of recession or economic downturn, local banks will be there to provide loan to small businesses.

If you run a small business and perform transactions in foreign countries, you can consider the option of applying for business loans at a big bank. However, you should be ready to pay higher rates of interest and incur a higher overall cost with national banks.

If you have a good credit score and positive cashflow, you can go for big banks, but if budget is your concern and you’re not in a position to pay the high rates at a big bank, local banks are the way to go. Small banks will offer great personalization and almost no checking fees. There are also low balance requirements for small business owners.