Working Capital Business Loan Types & Lenders

The Importance of Working Capital for small business owners managing cashflow

The owners of Silicon Valley Bank discovered a fundamental truth – when you don’t have the cash to meet your ongoing financial obligations – you don’t really have a business. Working capital is the cash you have available to pay your bills when they are due. It enables companies to cover the time gaps between selling a product or service and collecting cash payment for its sale. Working capital is calculated by subtracting current liabilities from current assets:

Working Capital = Current Assets – Current Liabilities

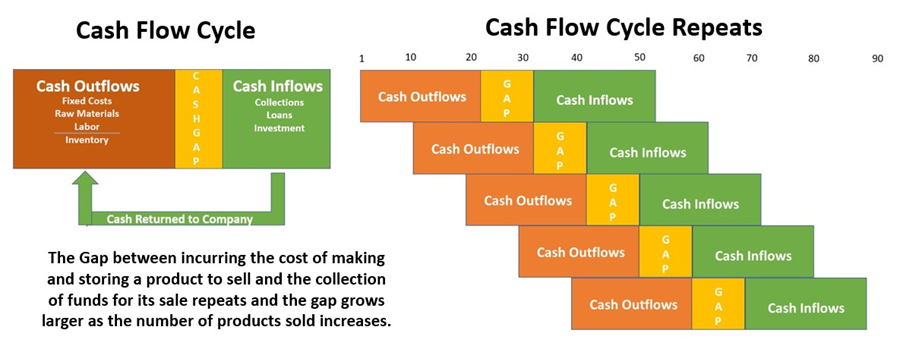

The amount of available working capital continuously changes based on a company’s costs of inventory, sales volumes, and the “cash conversion cycle” or working capital cycle” – the length of time required to turn net working capital (inventories, short-term non-cash assets, and accounts receivable). There is generally a gap between required expense payments and the collection of accounts receivable that working capital must cover.

Working Capital Cycle = Inventory Days + Receivable Days– Payable Days

Inventory Days = 365/(Cost of Goods Sold/((Ending Inventory – Beginning Inventory)/2)

Receivable Days = (Accounts Receivable/Total Sales) x 365

Payable Days = 365/(Purchases/((Beginning Accts Payable + Ending Accts Payable)/2)

Working capital management targets faster inventory turnover and receivable collection with extended periods between accounts payable payments. Attaining a negative ratio is unlikely. However, reducing the working capital cycle as low as possible lessens the need for additional working capital funds.

Building inventory to increase sales or implementing liberal credit terms increases the dollars needed to cover gaps in the working capital cycle. Extending accounts payable days may damage supplier relationships. Using working capital loans to cover cash flow shortages adds flexibility to current cash management practices.

Need for a Working Capital Loan

According to a JPMorgan Chase & Co. report, the average small business has slightly over $12,000 in its daily cash balance and an average outflow of $374 or about 32 days of payments. Business owners must consider whether their cash cushion can cover a significant business slowdown or closure. Is it time to consider a working capital loan?

Owners use working capital loans to supplement the capital needed to run a business. They’re designed to cover short-term cash needs from unexpected or seasonal sales or cash collection fluctuations. Before applying for a loan, a potential borrower should carefully consider the use of the borrowed funds, how much and how long the money is needed, and its repayment.

There is no single type of working capital loan, each based on the borrower’s industry, use, and financial history. Some lenders specialize in a single type of loan or a specific industry. Others serve the small business community at large. Some lenders offer flexible loan terms (within limits); others have a pre-determined, take-it-or-leave-it model with minimal adaptability. Whatever their approach, they share a common goal: avoiding losses.

The Lender’s Borrower Qualifications

Before extending a working capital loan, lenders consider a variety of borrower qualifications, including:

- Time In Business: The longer you’ve been in business, the easier to arrange a loan. Most lenders require a minimum of six months in business or more.

- Fico Score: Lenders typically require a minimum credit score before offering a loan. Credit scores also affect the borrower’s cost of a loan.

- Cash Flow: Lenders consider past monthly or annual revenue and expenses to determine the borrower’s ability to repay the loan as extended.

REQUIRED DOCUMENTS

| Approval | 3-4 bank statements |

| 3-4 months credit card sales |

| Documentation & Funding | Proof of ownership |

| Voided Check | |

| Driver’s License | |

| Legal Residency |

WORKING CAPITAL – Merchant Cash Advance

| CREDIT SCORE | 500 + |

| TIME IN BUSINESS | 3 MONTHS + |

| MONTHLY DEPOSITS – SALES | $3,000 to $750,000 |

| POSITIONS | 1ST, 2ND, 3RD + |

| RATE FACTOR AND RATES | 1.4 – 1.65 |

Borrower Considerations of Lenders

Applicants for working capital loans should carefully compare lender requirements before applying for a loan to minimize the chance of rejection, reduce the time between application and cash advance funding, and optimize the loan amount, interest rate, and repayment schedule. Potential borrowers should consider the lender’s

- Collateral requirements. Lenders often require a first lien on assets to secure working capital loans. In some cases, the loans may be unsecured. Some may require personal guarantees and individual financial statements of the owners of a business.

- Customer reviews. A simple online search, including the lender’s website, will identify sources of customer reviews or signs of negative news stories. Potential borrowers can check with State authorities, usually the Secretary of State, to confirm the lender’s right to do business within the State. Independent review sites like Trustpilot are also sources of customer reviews.

- Application process. The time between receipt of a loan application and funding varies between lenders. Banks and government lenders are notoriously slow to process applications, usually requiring weeks or months. When funds are approved, the applying company may be out of business. Online lenders typically process applications in less than a week.

- Additional borrower qualifications. Lenders typically publish their minimum borrower qualifications online to minimize deficit applications that waste each party’s time and money. Potential loan applicants should verify that they meet minimum lender standards before applying.

- Credit check process. Credit bureaus consider credit inquiries associated with a credit application as “hard.” They remain on the credit report for two years and can lower the FICO score. A “soft” credit check is not associated with a loan application and doesn’t affect FICO calculations. The lender’s type of credit inquiry has long-term effects.

- Necessary loan documentation. Each lender establishes the application’s required documentation. They typically require proof of legal status, copies of financial statements – balance sheet and income statement – for one to three years, personal and business tax records, and borrower’s identification through official documents. Some lenders may require a written business plan and financial projections.

BENEFITS AND DRAWBACKS

| Benefits: | Perfect credit not required. |

| No collateral required | |

| Providing funding to those un-bankables | |

| Opportunity for last resort funding | |

| Finance charges and fees should be 100% tax deductible | |

| Low documentation required | |

| Low credit required | |

| Low time in business required |

| Drawbacks: | Higher rate of interest. |

| Terms are shorter than traditional loans | |

| Option for consistent capital | |

| Credit requirement leniency |

The Working Capital Lenders have similarities and differences.

The selection of the following lenders is necessarily subjective. Their ranking depends on the criteria of evaluation. The list does not prioritize one lender over others; each can be the best choice for a specific borrower. The information contained herein was collected from public sources and is subject to change without notice.

Working capital lenders specialize in short-term business loans with a repayment period of around one year. Some have been in business for years, others more recent entries. Their requirements and capacity to make loans continuously change so that a market leader one year may fall into the pack in subsequent years.

SUMMARY:

Qualification Requirements

| CREDIT SCORE | 500+ |

| TIME IN BUSINESS | 3 MONTHS + |

| MONTHLY DEPOSITS – SALES | $3,000 TO $750,000 |

| LIEN & LENDER POSITIONS | 1ST, 2ND, 3RD + |

| RATE FACTOR AND RATES | 1.4-1.65 |

Transaction Fees

| Origination fees | 1% TO 7% |

| Admin Fees | $399 + |

Benefits and Drawbacks

| Benefits | Perfect credit not required. |

| No collateral required | |

| Funding for unbankables | |

| Opportunity last resort funding | |

| Fees are 100% tax deductible | |

| Low documentation required | |

| Low credit required | |

| Low time in business required |

| Drawbacks | Higher rate of interest. |

| Short-term than normal | |

| Option for consistent capital | |

| Credit requirement leniency |

REQUIRED DOCUMENTS

| Approval | 3-4 bank statements |

| 3-4 months credit card sales | |

| Documentation & Funding | Proof of ownership |

| Voided Check | |

| Driver’s License | |

| Legal Residency |